Welcome Back!

Let's Keep Working.

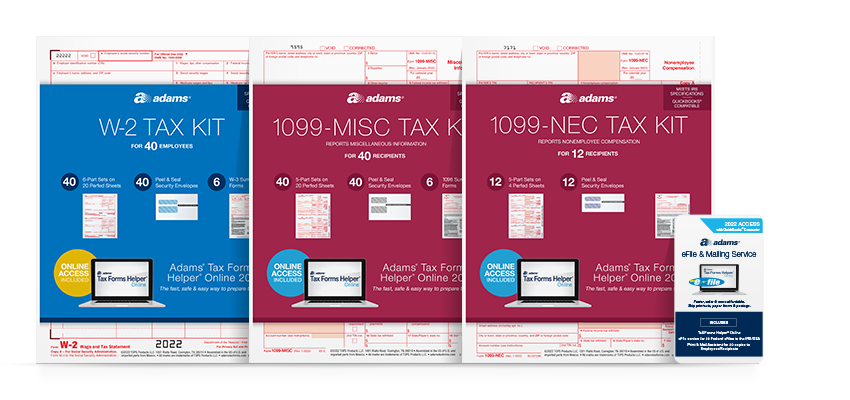

Whether you're filling out your forms, checking the status of a filing, or ready to e-file, Adams® Tax Forms Helper® makes it easier to achieve your goals. Let's finish tax season together.

LOG IN

SIGN UP